The global Sodium Bisulfite market stood at approximately 227 thousand tonnes in 2024 and is anticipated to grow at a CAGR of 3.24% during the forecast period until 2035.

Sodium Bisulfite serves a multitude of purposes across diverse industries owing to its versatile chemical properties. In the food industry, it acts as a potent preservative, preventing enzymatic browning and discoloration in various food products such as dried fruits, processed vegetables, and wine. Additionally, its role extends to water treatment, where it functions as a disinfectant and dechlorinating agent, ensuring the purity and safety of drinking water. In the realm of photography, sodium bisulfite finds application in developing solutions, where it serves to stabilize developing agents and halt the development process, facilitating the creation of photographic prints. Moreover, it plays a crucial role in the textile industry as a bleaching agent, aiding in the production of pristine fabrics and textiles. Its significance in the chemical sector lies in its capacity as a reducing agent, utilized in the synthesis of pharmaceuticals, polymers, and dyes. Furthermore, the paper and pulp industry utilize sodium bisulfite for lignin removal during the bleaching process, contributing to the production of high-quality paper products. In industrial processes, it acts as an effective scrubbing agent, removing harmful gases like sulfur dioxide from emissions. Notably, sodium bisulfite is indispensable in winemaking, where it serves as a sanitizer and preservative, safeguarding against oxidation and microbial contamination. Its applications extend to the leather industry, where it aids in the tanning process by removing impurities.

The surge in demand for Sodium Bisulfite is anticipated to be propelled by the robust growth in the water treatment sector. Sodium bisulfite is utilized in water treatment processes for dechlorination and reducing the concentration of free chlorine. With increasing concerns about water quality and stringent regulations regarding water treatment, the demand for sodium bisulfite in this sector is expected to rise. Also, the growing demand for processed and packaged foods, coupled with the need for extending shelf life, drives the demand for sodium bisulfite. Sodium bisulfite serves as a reducing agent in various chemical processes, including in the production of dyes, pharmaceuticals, and other chemicals. Growth in these industries will positively impact the sodium bisulfite market. Sodium bisulfite is used in the textile industry for bleaching and reducing agents in dyeing processes. As the textile industry continues to grow, particularly in emerging economies, the demand for sodium bisulfite in this sector may see steady growth. The global Sodium Bisulfite market is likely to reach approximately 320 thousand tonnes in 2035.

Based on region, Asia Pacific region is anticipated to dominate as the largest consumer of Sodium Bisulfite globally, primarily driven by several factors. In 2024, the Asia-Pacific region continued its role as the foremost consumer of sodium bisulfite, holding largest share of the global market and is likely to display the same behaviour in the upcoming years. This dominance is underpinned by several key factors, including the region's rapid industrialization, which drives increased demand for sodium bisulfite across various applications, particularly in water treatment. Additionally, the region's large and growing population contributes to a higher demand for clean water and processed food products, both of which rely on sodium bisulfite. Furthermore, stringent regulations on water quality in many Asia-Pacific countries are leading to a greater adoption of efficient water treatment methods, further boosting the consumption of sodium bisulfite.

Based on the end-user industry, the global Sodium Bisulfite market is divided into Water Treatment, Pulp & Paper industry, Food & Beverage, Textile and Others. Among these, Water Treatment sector is the dominating segment and held about 43% of the global Sodium Bisulfite market in 2024.

Major players in the Global Sodium Bisulfite market are Choice Chemicals Ltd., Gaomi Kaixuan Disinfection Products Co., Ltd., Hunnan Yinqiao Food Additive Co.,Ltd, Meizhou Lianjin Chemical Industry Limited Company, Chemtrade Logistics Inc., Shanti Inorgochem Pvt.Ltd. and Others.

Years considered for this report:

Historical Period: 2015- 2023

Base Year: 2024

Estimated Year: 2025

Forecast Period: 2026-2035

This report will be delivered on an online digital platform with one-year subscription and quarterly update.

Objective of the Study:

• To assess the demand-supply scenario of Sodium Bisulfite which covers production, demand and supply of Sodium Bisulfite market in the globe.

• To analyse and forecast the market size of Sodium Bisulfite

• To classify and forecast Global Sodium Bisulfite market based on end-use and regional distribution.

• To examine competitive developments such as expansions, mergers & acquisitions, etc., of Sodium Bisulfite market in the globe.

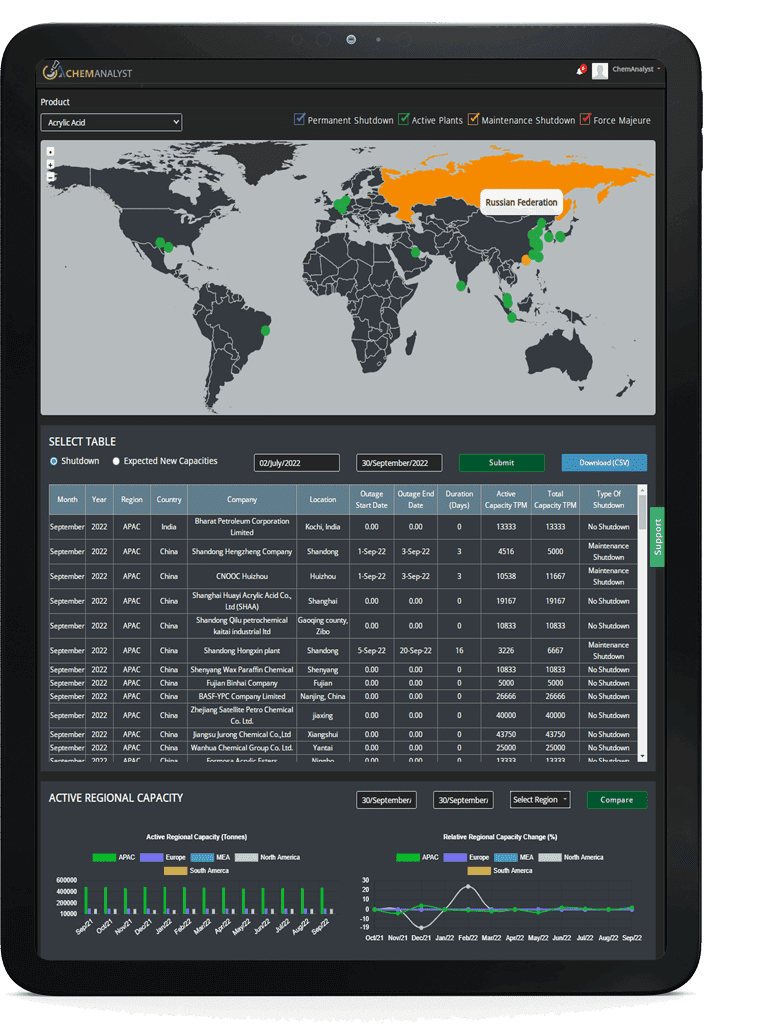

To extract data for Global Sodium Bisulfite market, primary research surveys were conducted with Sodium Bisulfite manufacturers, suppliers, distributors, wholesalers and Traders. While interviewing, the respondents were also inquired about their competitors. Through this technique, ChemAnalyst was able to include manufacturers that could not be identified due to the limitations of secondary research. Moreover, ChemAnalyst analyzed various segments and projected a positive outlook for Global Sodium Bisulfite market over the coming years.

ChemAnalyst calculated Sodium Bisulfite demand across the globe by analyzing the volume of Sodium Bisulfite consumed by the end-user industries and the forecast is calculated based on the growth rate of end-use industries. ChemAnalyst sourced these values from industry experts and company representatives and externally validated them by analyzing the historical sales data of respective manufacturers to determine the overall market size. Various secondary sources such as company websites, association reports, annual reports, etc., were also studied by ChemAnalyst.

Key Target Audience:

• Sodium Bisulfite manufacturers and other stakeholders

• Organizations, forums and alliances related to Sodium Bisulfite distribution

• Government bodies such as regulating authorities and policy makers

• Market research organizations and consulting companies

The study is useful in providing answers to several critical questions that are important for industry stakeholders such as Sodium Bisulfite manufacturers, customers and policy makers. The study would also help them to target the growing segments over the coming years (next two to five years), thereby aiding the stakeholders in taking investment decisions and facilitating their expansion.

Report Scope:

In this report, Global Sodium Bisulfite market has been segmented into following categories, in addition to the industry trends which have also been detailed below:

|

Attribute

|

Details

|

|

Market size Volume in 2024

|

227 thousand tonnes

|

|

Market size Volume in 2035

|

320 thousand tonnes

|

|

Growth Rate

|

CAGR of 3.24% from 2024 to 2035

|

|

Base year

|

2024

|

|

Estimated year

|

2025

|

|

Historical Data

|

2015 – 2023

|

|

Forecast period

|

2026 – 2035

|

|

Quantitative units

|

Demand in thousand tonnes and CAGR from 2025 to 2035

|

|

Report coverage

|

Industry Market Size, Capacity by Company, Capacity by Location, Operating Efficiency, Production by Company, Demand by End- Use, Demand by Region, Demand by Sales Channel, Demand-Supply Gap, Company Share, Manufacturing Process.

|

|

Segments covered

|

By End-Use: (Water Treatment, Food & Beverage, Textile, Pharmaceuticals, and Others)

By Sales Channel: (Direct Sale and Indirect Sale)

|

|

Regional scope

|

North America, Europe, Asia Pacific, Middle East and Africa, and South America.

|

|

Pricing and purchase options

|

|

Available Customizations:

With the given market data, ChemAnalyst offers customizations according to a company’s specific needs.

In case you do not find what, you are looking for, please get in touch with our custom research team at sales@chemanalyst.com