H1 2023: Prominent players in the Global Paraxylene market in H1 2023 were China Petroleum & Chemical Corporation (Sinopec), Reliance Industries Limited, and Exxon Mobil Corp. However, China Petroleum & Chemical Corporation (Sinopec) held the largest production capacity in terms of producing Paraxylene. However, Reliance Industries Limited has roughly 8% of the global market share. In March 2023, Pengerang Energy Complex Sdn. Bhd. announced that it has inked important agreements with many blue-chip partners for their Pengerang Energy Complex (PEC) which are worth USD 102 billion. This complex is located in Pengerang Integrated Petroleum Complex (PIPC) in Johor, Malaysia. The strategic feedstock supply and product off-take agreements signed with the world's top energy companies Chevron and Equinor, the Thai national oil company PTT, and Mitsui & Co., Ltd. valued at a total of USD 102 billion and will cover all of PEC's requirements for the first twelve years. PEC is anticipated to be operation in 2026. Regionally, Asia Pacific region was the leading consumer of paraxylene. In China, paraxylene prices saw an increasing trend following the spring festival as demand from China's downstream industries increased. Due to the shutdown of some major factories, including China Petroleum & Chemical Corporation (Sinopec), which had their site shut for maintenance purpose from January 2023 to the end of February 2023. Owing to this, there was a limited supply of Paraxylene in the market and healthy demand by the downstream PTA sector which is further used to make PET.

The global Paraxylene market has expanded to reach approximately 62 million tonnes in 2023 and is expected to grow at a healthy CAGR of 4.67% during the forecast period until 2034. The Paraxylene market's primary driver is the expanding demand for plastic products in the packaging sector with industrialization across the globe.

Paraxylene is an aromatic hydrocarbon with chemical formula C8H10. It is also known is p-xylene. It is one of the three isomers of dimethylbenzene that are referred to as xylenes as a whole. In this compound, the methyl groups (CH3) are placed diagonally to each other in the benzene molecule. Usually, p-Xylene is synthesized by catalytic reforming of petroleum naphtha. Paraxylene is an essential chemical (to manufacture industrial chemicals such as Purified Terephthalate (PTA), Dimethyl Terephthalate (DMT), Terephthalic Acid (TPA). These chemicals are most widely employed to manufacture plastics called polyethylene terephthalate (PET) polyesters. With the substantial increase in the PET demand throughout the projection period in the beverage bottling and food packaging industries, as well as in the automotive, electronics, and construction sectors, the paraxylene market would be significantly influenced.

The primary driving factor influencing the market is the rising demand for plastics on a global scale. The primary ingredient in the creation of plastic products is xylene. It is used to create polyethylene terephthalate (PET) bottles, which are frequently used as drink containers for coke, water, and other beverages. Additionally, paraxylene is used to make a variety of home items, including apparel, furnishings, and containers for cosmetics and toiletries. The global Paraxylene market is anticipated to reach 102 million tonnes by 2034.

As of 2023, based on region-wise consumption, Asia Pacific dominates the Paraxylene market with a consumption of approximately 67% of the global Paraxylene market. Due to growing demand of Paraxylene for manufacturing plastics for bottles, containers and packaging materials in developing countries like India, China, Malaysia, and Japan generating substantial growth prospects for the market in the forecast period till 2034. Moreover, Asia Pacific also dominates as the producer of the global Paraxylene market, with China and India being the key players.

Based on the end-use, the global Paraxylene market is segregated into Purified Terephthalate, Dimethyl Terephthalate, and Others. As of 2023, the Purified Terephthalate industry is dominating the Paraxylene market with a market share of 94%. PTA is a versatile chemical used to manufacture a wide array of plasticizers and polymers such as polyethylene terephthalate, polybutylene terephthalate (PBT), terephthaloyl chloride, liquid crystal polymer. PTA is also extensively used to manufacture PET (Polyethylene Terephthalate), which further used by the food & beverage sector for packaging purposes.

Major players in the production of Global Paraxylene are China Petroleum & Chemical Corporation (Sinopec), Reliance Industries Limited, Hengli Petrochemical refinery, China National Petroleum Corporation, SK Global Chemical, Zhejiang Petroleum & Chemical Co Ltd, Qingdao Lidong Chemical, Sinochem Energy, and Others.

Years considered for this report:

Historical Period: 2015- 2022

Base Year: 2023

Estimated Year: 2024

Forecast Period: 2025-2034

This report will be delivered on an online digital platform with one-year subscription and quarterly update.

Objective of the Study:

• To assess the demand-supply scenario of Paraxylene which covers production, demand and supply of Paraxylene market in the globe.

• To analyse and forecast the market size of Paraxylene

• To classify and forecast Global Paraxylene market based on end-use and regional distribution.

• To examine competitive developments such as expansions, mergers & acquisitions, etc., of Paraxylene market in the globe.

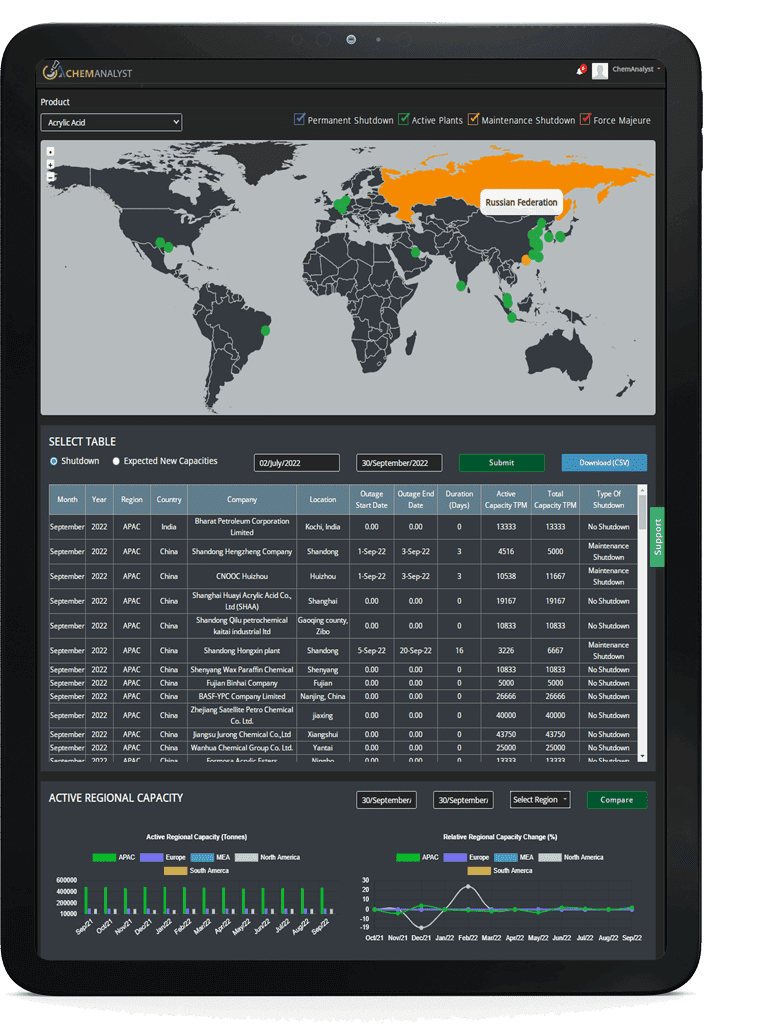

To extract data for Global Paraxylene market, primary research surveys were conducted with Paraxylene manufacturers, suppliers, distributors, wholesalers and Traders. While interviewing, the respondents were also inquired about their competitors. Through this technique, ChemAnalyst was able to include manufacturers that could not be identified due to the limitations of secondary research. Moreover, ChemAnalyst analyzed various segments and projected a positive outlook for Global Paraxylene market over the coming years.

ChemAnalyst calculated Paraxylene demand in the globe by analyzing the historical data and demand forecast which was carried out considering the historical supply and demand of Paraxylene across the globe. ChemAnalyst sourced these values from industry experts, and company representatives and externally validated through analyzing historical sales data of respective manufacturers to arrive at the overall market size. Various secondary sources such as company websites, association reports, annual reports, etc., were also studied by ChemAnalyst.

Key Target Audience:

• Paraxylene manufacturers and other stakeholders

• Organizations, forums and alliances related to Paraxylene distribution

• Government bodies such as regulating authorities and policy makers

• Market research organizations and consulting companies

The study is useful in providing answers to several critical questions that are important for industry stakeholders such as Paraxylene manufacturers, customers and policy makers. The study would also help them to target the growing segments over the coming years (next two to five years), thereby aiding the stakeholders in taking investment decisions and facilitating their expansion.

Report Scope:

In this report, Global Paraxylene market has been segmented into following categories, in addition to the industry trends which have also been detailed below:

|

Attribute

|

Details

|

|

Market size Volume in 2023

|

62 million tonnes

|

|

Market size Volume by 2034

|

102 million tonnes

|

|

Growth Rate

|

CAGR of 4.67% from 2024 to 2034

|

|

Base year for estimation

|

2024

|

|

Historic Data

|

2015 – 2023

|

|

Forecast period

|

2025 – 2034

|

|

Quantitative units

|

Demand in million tonnes and CAGR from 2024 to 2034

|

|

Report coverage

|

Industry Market Size, Capacity By Company, Capacity by Location, Production by Company, Demand by End- Use, Demand by Region, Demand by Sales Channel, Demand-Supply Gap, Foreign Trade, Company Share, Manufacturing Process, Policy and Regulatory Landscape

|

|

Segments covered

|

By End-Use: (Purified Terephthalate, Dimethyl Terephthalate, and Others)

By Sales Channel: (Direct Sale and Indirect Sale)

|

|

Regional scope

|

North America, Europe, Asia Pacific, Middle East and Africa, and South America.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Available Customizations:

With the given market data, ChemAnalyst offers customizations according to a company’s specific needs.

In case you do not find what, you are looking for, please get in touch with our custom research team at sales@chemanalyst.com