Welcome To ChemAnalyst

Russian invasion of Ukraine continues in its 5th day amid diplomatic talks between the two countries in Belarus. Russian invasion has been highly condemned and criticized by the West while East opted for peaceful negotiations between the two countries. West has been severe in its reprisals and sanctions have been imposed in order to isolate Russia from the financial systems. Consequently, Russia has been ousted from SWIFT payment system.

Impact of Russia-Ukraine war on oil and Gas has been more than evident where ICE Brent was trading in excess of USD 105 per barrel while WTI transverse USD 100 per barrel. Repercussions of Russia-Ukraine war are likely to appear on global convertors’ margins, as crude value has already started hampering their margins. However, key players in Asia and Middle East including ONGC and SABIC shall reap some short-term benefits post steep escalation in price of global crude oil value.

The strong bullish rally of crude oil is likely to result in robust prices of derivatives and consequently, olefins are likely to observe another round of price increase. Rise in prices of Ethylene and propylene will further snowballed into price gains for several downstream products.

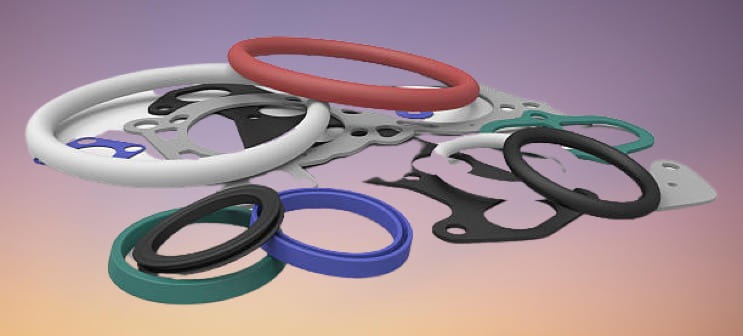

EPDM rubber which relies heavily on Ethylene and Propylene as feedstock is likely to turn bullish as manufacturers will face inflationary pressure from upstream feedstocks and Catalysts. This will be an ideal time for manufacturers to gain market as automotive industry has been projected to improve production after three consecutive quarters of stagnancy. EPDM has been widely employed in automotive industry and market participants will look to secure material ahead of sharp increase in demand.

Different regions can face varied increase in prices of EPDM rubber where South Korea, a key piece in the global EPDM rubber puzzle, may observe price increase of 5-7% in the next quarter while European market may gain much more (8-10%) as Natural gas prices and supply chain constraints are expected to inflate prices further consolidating on bullish rally of monomers and catalysts. Among European countries, Black Sea neighbouring countries may observe significant inflation in prices.

As per ChemAnalyst, “EPDM market is expected to change momentum and likely to turn bullish gaining from monomers and catalysts and constrained supply chains in coming months. Furthermore, it has been highly recommended that the invasion should be halted with immediate effect limiting loss of life and property. This will not only be geopolitically and economically prudent but also show humanitarian values.”

We use cookies to deliver the best possible experience on our website. To learn more, visit our Privacy Policy. By continuing to use this site or by closing this box, you consent to our use of cookies. More info.